California State Tax Withholding Form 2025 Lok

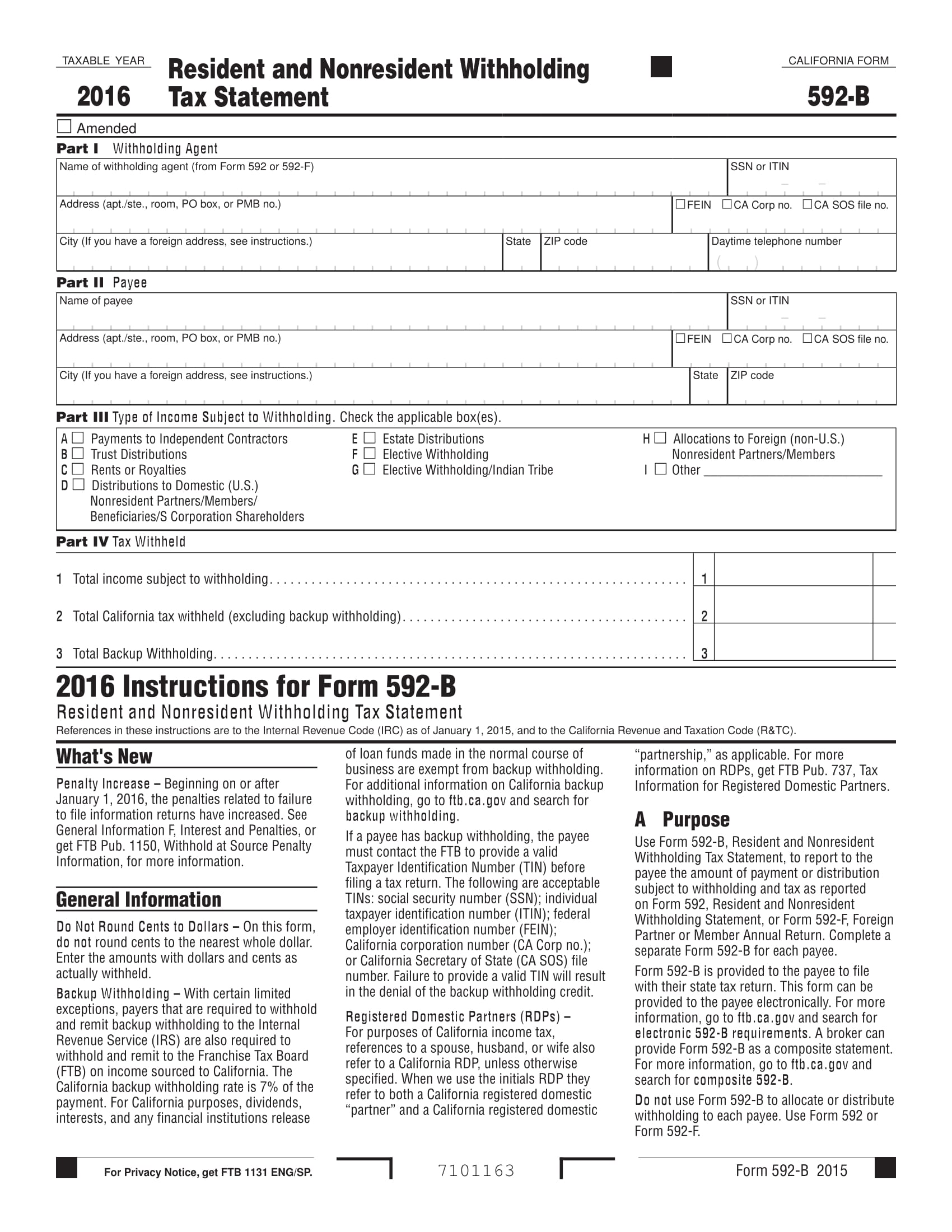

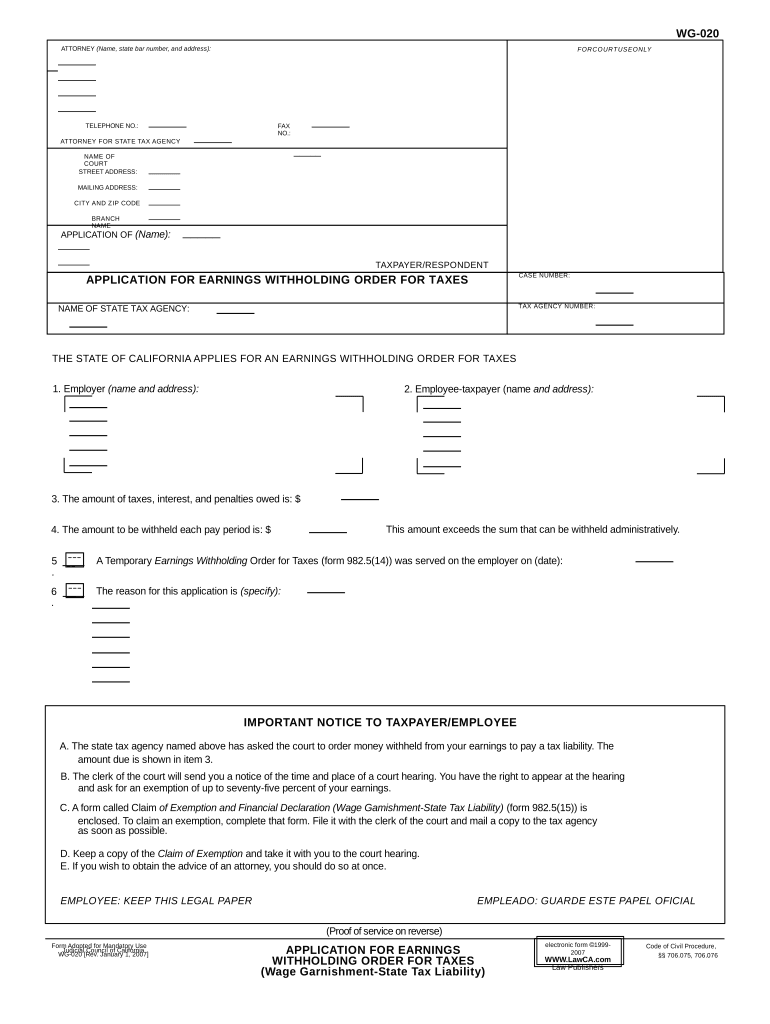

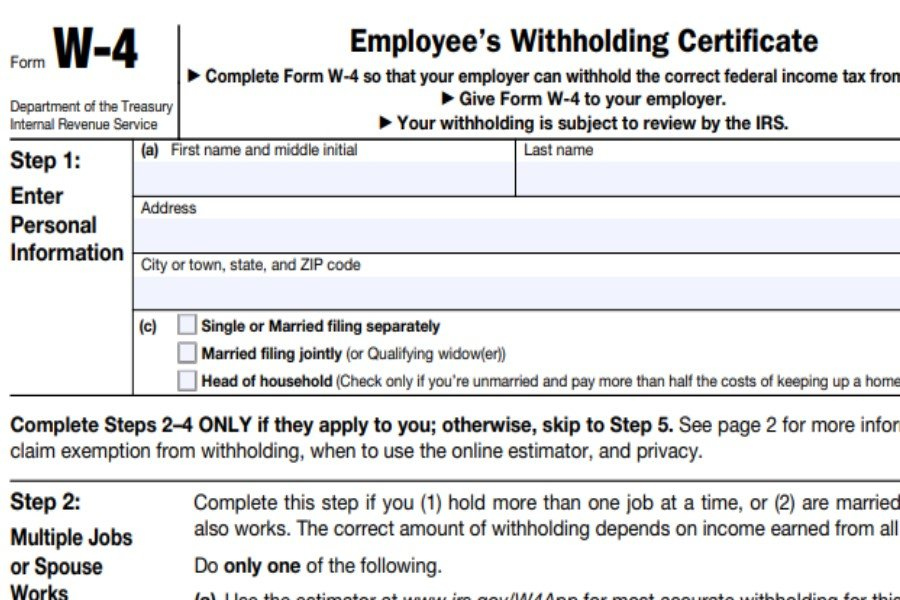

BlogCalifornia State Tax Withholding Form 2025 Lok. Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. The form helps your employer.

Each person that is earning a wage in the state of california, regardless of where they actually live, or living. The 2025 tax rates and thresholds for both the california state tax tables and federal tax tables are comprehensively integrated into the california tax calculator for 2025.

California State Tax Withholding Form 2025 S Shari Carmelle, Consider regular retirement fund contributions, as it reduces your taxable income and tax liability.

California Withholding Schedules For 2025 Betty Chelsey, Filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california.

California State Tax Withholding Form 2025 S Naoma Gwendolin, Withholding from an ira distribution for california income taxes is not mandatory.

California State Tax 2025 Form Jackie Germana, Divide the annual california income tax withholding by > 26 < to obtain the biweekly california income tax withholding.

Will The Next Olympics Be In 2025 Or 2025 Tax Return Charla Adriane, You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to.

Ca State Tax Brackets 2025 Bobbi Chrissy, Estimate your tax liability based on your income, location and other conditions.

How Much Withholding Should I Claim On W4 2025 Liane Othelia, The california tax estimator lets you calculate your state taxes for the tax year.

W4 Calculator 2025 Irs Aimee Cynthea, Divide the annual california income tax withholding by > 26 < to obtain the biweekly california income tax withholding.